|

|

|

|

|

|

|

home

about

features

A-Z

books

|

|

features

|

| |

Imperial drinking in Russia

by Alexander Yurov, RIA Novosti, 05/2006

Russians are definitely not foreign to such beer styles as Porter or Imperial Stout. "English-brewed" beers came to Russia almost 300 years ago under Tsarina Elizabeth, the daughter of Peter the Great, who was fond of the

dense and dark beverage.

Later, Catherine the Great had the first Russian porter brewery built in St. Petersburg. The first Russian-brewed English beer, brewed with English malt and hops, came from Russian merchant Ivan Chirkin's breweries in 1750. His follower Stepan Usachev found

all necessary raw products in Russia, which by the beginning of the 19th century made dark beers more affordable for the general public. In 1814, local authorities even had to limit the number of 'porter shops' - so called

because they sold beer, whilst drinking on tap was strictly prohibited - to 30 in St. Petersburg and four in Moscow.

|

|

|

Six years later the prohibitive decree was withdrawn. In 1824, all limitations were lifted, which brought the overall number of beer shops in St. Petersburg alone to more than 200 in the 1850s and around 1,000 by the 1900s.

While restrictions were still in place for drinking in public places, beer was getting increasingly popular amid bad news for dark beers squeezed out of the market by "new" Pilsener lager.

After the Soviet Revolution, porter was not prohibited but almost disappeared as free market was gone. "English-style" beers were produced only in Leningrad (now St. Petersburg), in the Baltic republics, and in Lvov

(Western Ukraine). The Soviet authorities limited the number of open beerhouses in Leningrad, by then Russia's second most important city, to a mere hundred, and very few of them sold dark beers on tap.

|

|

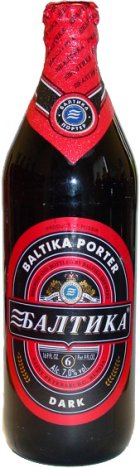

The post-communist era has marked a comeback for Russian dark beers. Currently the most popular is the local #6 Baltika Porter. At 17% Plato, it is as strong as Imperial Stout. Another St. Petersburg-brewed dark

Stepan Razin Porter is a traditional 20-% higher-IBU brand which tastes more like the bitterer Imperial Stouts. Tver, a city near Moscow, produces its own Afanasy porter, very much like Stepan Razin.

Porter is also brewed in Moscow (Moskvoretsky Porter), Yaroslavl (Yarpivo), Sarapul, Tomsk, Nizhny Tagil, and Ryazan. There are also many local small producers who also offer what they describe as "true porter," which is

rarely the case. Their beer typically has 13% Plato and a taste of a concentrated dark ale.

The past few years have been rather turbulent for the Russian beer industry, expanding the overall market by 5% per year on average. The current scale of the beer market is 90 million hectoliters per year, and this

despite the authorities have not missed a single chance to increase the beer excise tax. Market researchers predict over half the global consumption of beer is going to move to Russia and China in the coming years.

The Russian market, naturally, has not avoided the advent of global beer groups. Baltika, the St. Petersburg-based company that controls over 20% of the market and has long earned a reputation of the "most Russian" beer

with its 18 breweries across the nation and the CIS, is in fact an international conglomerate owned by the Baltic Beverages Holding - an entity founded in 1991 by Danish Carlsberg Breweries A/S and Finnish Hartwall. In the

latest major asset reshuffle, the Finns sold their stake to the British company Scottish & Newcastle for $1.7 billion.

|

Sun Interbrew, the Russian unit of Inbrev, a multinational largely owned by Belgians, is firmly second with a recent record of fast growth in its eight Russian production venues. It is under pressure from Heineken who came to

Russia later than others but has since taken control of four breweries and 8.6% of the market in terms of revenue, the fastest growth rate ever.

The two Russian breweries, Ochakovo and Krasny Vostok, still independent of internationals, control about 15% of the market.

But the Russian media have been rife with rumors of an

impending breakthrough on the beer market, with Anheuser-Busch, an aggressive U.S. player, expected to court one of independent Russians later this year. Another multinational to watch is SABMiller, one of the fastest

growing beer firms across the globe, known in Russia for famous Czech brands as well as for a range of local beers.

So far, their strategy has been to establish holding companies, rather than buy operational enterprises out.

|

|

|

Pavel Shapkin, chairman of Russia's association of alcohol producers, doubted whether the overseas player - whatever popular its current brands are - would cause tectonic shifts on the Russian market. Newcomers find it

increasingly hard to elbow their way to prominence amid tight competition and sell foreign brands to customers largely loyal to local beers. Though foreign beers are popular in Russia, such prominent brands as

Heineken, Amstel, and Bud are well below the top five. At the same time, Russian brands bring profits to foreigners. The beer market is all but closed for domestic capital, and is hardly subject to fundamental changes.

While not expected to change their beer habits, the Russians are highly likely to come back to old ones, which directly applies to "English" beers. Moscow Mayor Yuri Luzhkov has been arranging annual St.

Patrick's Day celebrations in the city since March 15, 1992 when the first parade of band elements, mounted Cossacks, and 15 truck-based adverts of Russian and Irish companies went through downtown Moscow.

Later a beer festival was added to the celebrations.

Another important source of proliferation of dark beers is the expanding network of British-style good-old-England pubs that has already spread beyond Moscow and St. Petersburg - to Oryol, Krasnoyarsk etc. Indeed, back in

2000 Vladimir Putin entertained Tony Blair to one 'Runglish' pub, the popular Pivnushka in St. Petersburg.

|

|

home

about

features

A-Z

books

|